Business Insurance in and around Morton

Looking for protection for your business? Search no further than State Farm agent Gina Jeffries!

Cover all the bases for your small business

Cost Effective Insurance For Your Business.

Running a small business comes with a unique set of wins and losses. You shouldn't have to face those alone. Aside from just your family and friends, let State Farm be part of your line of support through insurance options including worker's compensation for your employees, business continuity plans and errors and omissions liability, among others.

Looking for protection for your business? Search no further than State Farm agent Gina Jeffries!

Cover all the bases for your small business

Cover Your Business Assets

Why choose State Farm for coverage? Your fellow business owners have rated State Farm as one of the top overall choices for insurance coverage by small business owners like you. You can work with State Farm agent Gina Jeffries for a policy that safeguards your business. Your coverage can include everything from errors and omissions liability or extra liability coverage to key employee insurance or employment practices liability insurance.

Call Gina Jeffries today, and let's get down to business.

Simple Insights®

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.

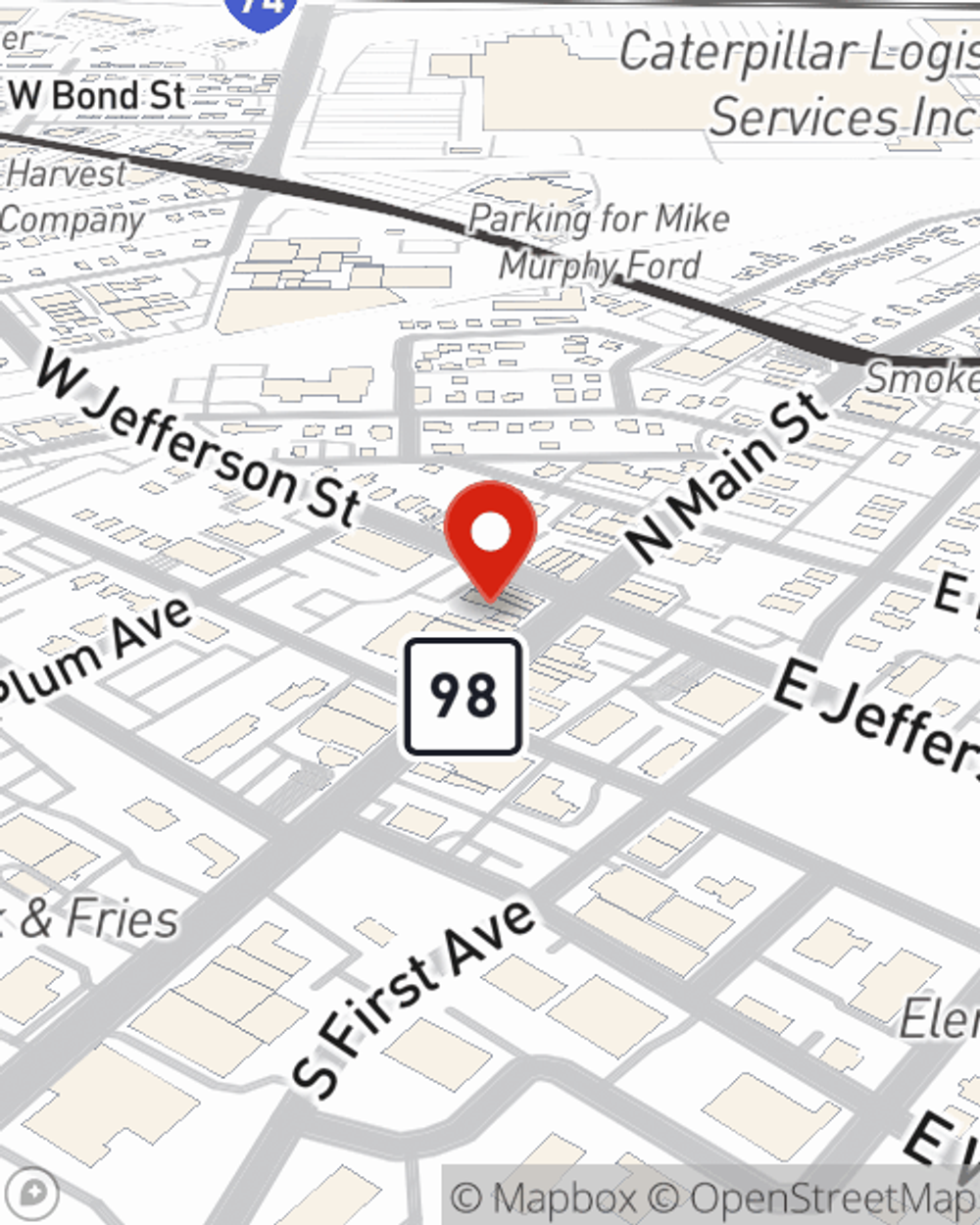

Gina Jeffries

State Farm® Insurance AgentSimple Insights®

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.