Life Insurance in and around Morton

Insurance that helps life's moments move on

What are you waiting for?

Would you like to create a personalized life quote?

It's Time To Think Life Insurance

It may make you pained to entertain ideas about when you pass away, but preparing for that day with life insurance is one of the most significant ways you can express love to your partner.

Insurance that helps life's moments move on

What are you waiting for?

Morton Chooses Life Insurance From State Farm

The beneficiary designated in your Life insurance policy can help cover current and future needs for your loved ones when you pass away. The death benefit can help with things such as your funeral costs, college tuition or childcare costs. With State Farm, you can rely on us to be there when it's needed most, while also providing sensitive, reliable service.

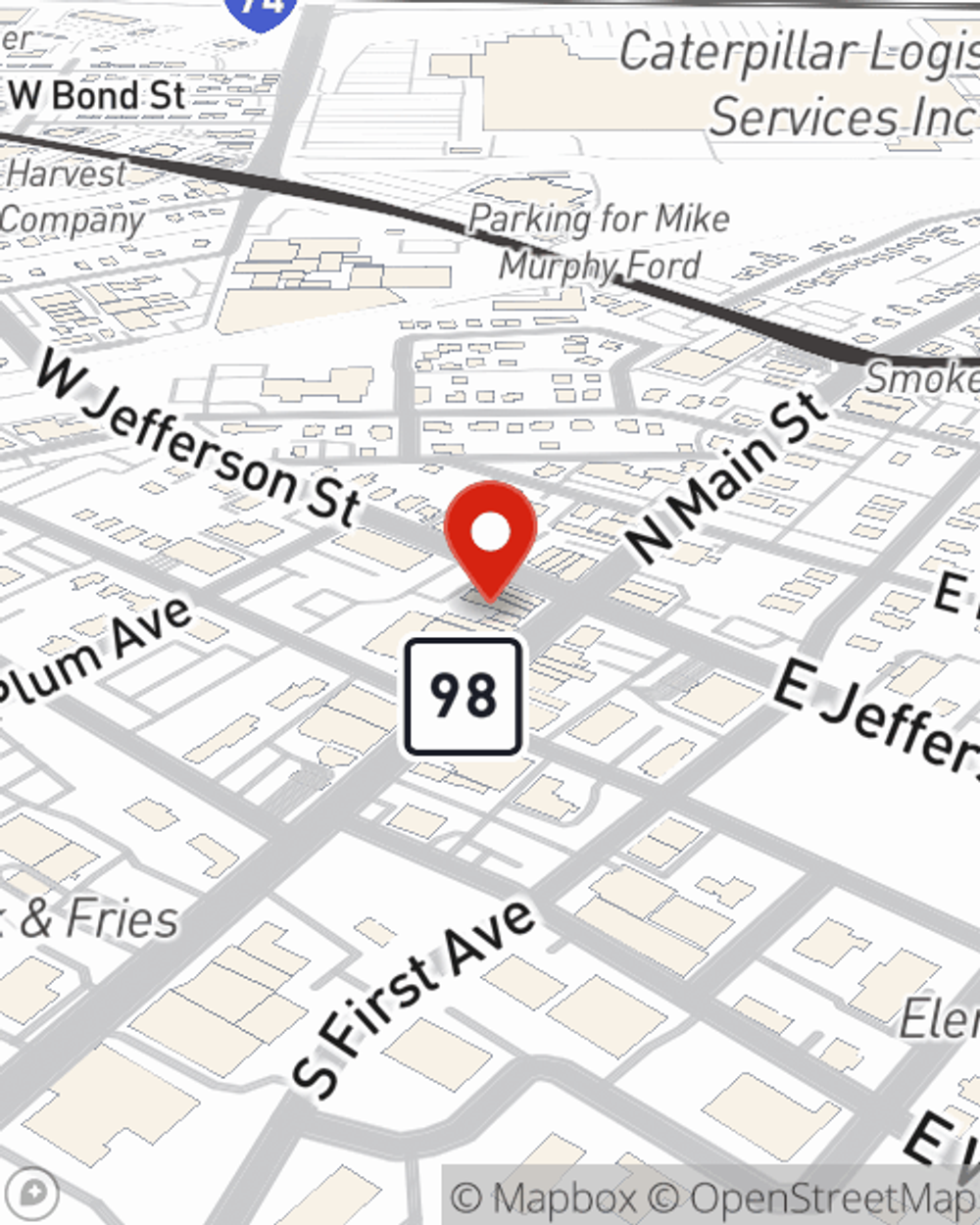

With responsible, considerate service, State Farm agent Gina Jeffries can help you make sure you and your loved ones have coverage if something bad does happen. Visit Gina Jeffries's office today to get started on the options that are right for you.

Have More Questions About Life Insurance?

Call Gina at (309) 866-3050 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Enjoy flexible premiums and protection with Universal Life insurance

Enjoy flexible premiums and protection with Universal Life insurance

A universal life insurance policy has flexible premiums, guaranteed returns on cash value, and either a level or variable death benefit.

What is Return of Premium life insurance?

What is Return of Premium life insurance?

What if a life insurance policy refunded all the premiums you paid if you outlive the term. That's the premise behind Return of Premium life insurance.

Gina Jeffries

State Farm® Insurance AgentSimple Insights®

Enjoy flexible premiums and protection with Universal Life insurance

Enjoy flexible premiums and protection with Universal Life insurance

A universal life insurance policy has flexible premiums, guaranteed returns on cash value, and either a level or variable death benefit.

What is Return of Premium life insurance?

What is Return of Premium life insurance?

What if a life insurance policy refunded all the premiums you paid if you outlive the term. That's the premise behind Return of Premium life insurance.